Calgary, Alberta – January 12, 2022 – Kiwetinohk Energy Corp. provides a corporate update and announces its 2022 capital expenditures budget and production guidance.

“This budget is designed to deliver strong baseline cash flow from the upstream business while advancing power projects toward FID,” said CEO Pat Carlson. “The 2022 budget is a further step toward our goal of being a low-cost supplier of natural gas and reliable, dispatchable, low-emission gas-fired and renewable electricity.”

Highlights

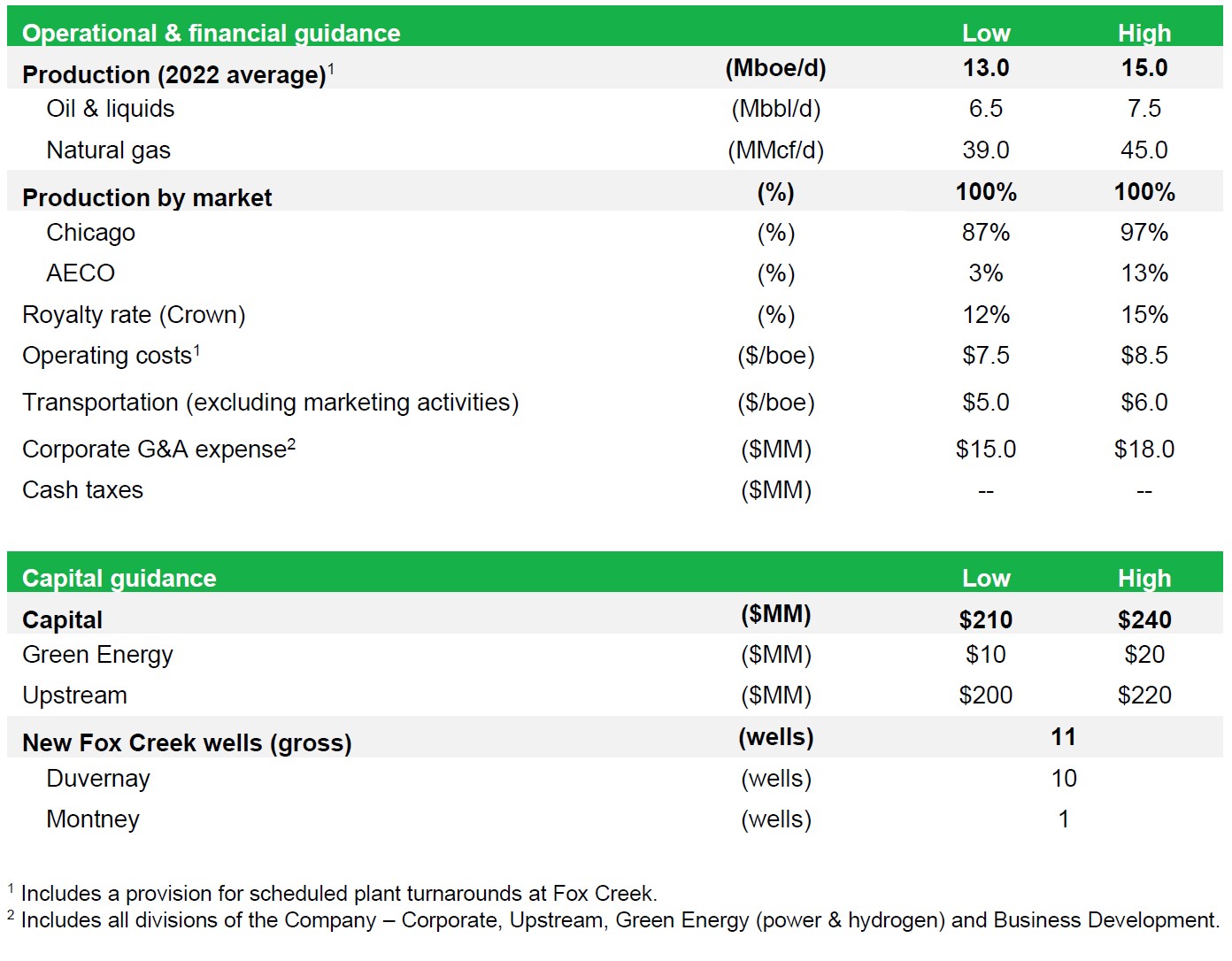

- Production guidance for 2022 of 13,000 to 15,000 boe/d with 5 of 11 gross wells to be completed in 2023;

- 2022 capital expenditures budget of $210 to $240 million (subject to commodity prices after hedging) including $10 to $20 million allocated to green energy;

- Advancing five solar and gas-fired power projects totaling 1,800 megawatts (MW) of nameplate generation capacity toward Final Investment Decision (FID);

- At US$70/bbl WTI and US$3.75/MMBtu Henry Hub, expected to deliver approximately $120 to $150 million of Adjusted Funds Flow(1) and 22% – 28% return on average capital employed(2) supported by strong marketing and commodity hedging positions;

- The Toronto Stock Exchange (the TSX) has confirmed that Kiwetinohk’s common shares will be listed on the TSX on Friday, January 14 with the trading symbol KEC;

- The Company’s corporate presentation can be found at www.kiwetinohk.com.

Green Energy update and capital expenditures

Kiwetinohk has allocated $10 to $20 million of capital in 2022 for pre-FID planning and approvals and securing financing to advance power projects to FID. The Company expects to spend, depending on the project, $3 to $8 million to bring each project to FID. At FID, the Company expects to retain a carried-partnership interest that reflects the higher risk to which it has been exposed to achieve FID. Although Kiwetinohk is also considering other financial structures, this approach to financing, when it works as planned, will enable Kiwetinohk to participate in projects of this nature with returns aligned with its upstream business.

The five power projects with a total nameplate generation capacity of 1,800 MW in early-stage development include:

- one 101 MW Firm Renewable(3) project in the Alberta Electric System Operator (AESO) Stage 2;

- two solar projects in AESO Stage 1 and 2 for a total of 700 MW; and

- two natural gas combined cycle (NGCC) projects in AESO Stage 1 and 2 for a total of 1,000 MW.

The Company is targeting to have a 400 MW solar project and the 101 MW Firm Renewable project achieve FID by year-end 2022.

Kiwetinohk made significant progress in 2021 in advancing its diversified, solar and gas-fired development power portfolio including site selection and acquisition, permitting, environmental studies, community engagement, AESO stage advancement and engineering and economic evaluation. In addition to its ongoing greenfield development program, the Company is evaluating acquisition and partnership opportunities for pre-construction solar and wind projects, as well as hydrogen production opportunities, which complement and expand Kiwetinohk’s existing power portfolio. The Company has updated the target FID and Commercial Operation Date (COD) for its first Firm Renewable and its 400 MW solar project to year-end 2022 and year-end 2024.

The Company’s ten-year vision is to generate over 1,500 MW of electricity (over 10% of Alberta grid capacity) from solar, wind and natural gas, with a goal to capture over 90% of the carbon associated with the Company’s gas-fired power and hydrogen production operations.

Upstream capital expenditures and guidance

The 2022 upstream capital budget is $200 to $220 million and production guidance is 13,000 to 15,000 boe/d. Expenditures will be subject to commodity prices and will focus in Kiwetinohk’s Fox Creek core area where the Company plans to drill 11 gross wells. During 2022 Kiwetinohk expects to bring 4 wells drilled in late 2021 onto production in the first half of the year, 6 of the 11 new 2022 drilled wells onto production in the second half of the year and 5 of the 11 new 2022 drilled wells onto production in the first half of 2023. Detailed execution plans will address limited surface access and preservation of protected species requirements in Fox Creek. As a result, Kiwetinohk estimates an average time from start of drilling to production of 8 months for the well pads in this year’s program.

The Fox Creek core area provides a low decline production base from which to grow but also requires some investment lead-time due to under-investment for the past few years. Kiwetinohk plans to invest in Fox Creek to increase production and cash flow. Future free cash flow can be channeled to fund additional green energy investment and return capital to investors. The plan is to integrate low-cost natural gas production with clean, reliable, dispatchable and low-cost electricity and hydrogen. The Company acquired these assets for ~$10/boe Proved Developed Producing (PDP) Reserves, or ~$4/boe Total Proved (TP) Reserves, and the assets had a operating netback (before financial hedging) of ~$31/boe in the third quarter of 2021, resulting in a >3x recycle ratio(4).

2022 will be an investment year to arrest declines and commence growing production to fill the property’s facilities, which are currently operating at less than half capacity at Fox Creek. A total of $170 to $185 million is budgeted for drilling, completing, equipping and tie-in (DCET) activity during 2022. The production profile will be back-end weighted with 5 of 11 new wells anticipated to come on production in 2023. As a result of the planned drilling schedule, Kiwetinohk expects production to average 20,000 to 21,000 boe/d during the first quarter of 2023 increasing from currently expected production for first quarter of 2022 of 11,000 to 12,000 boe/d. Anticipated production for Q1 2022 reflects:

- natural production declines;

- typical first quarter weather-related production interruptions;

- minimal contribution from the Company’s drilling activity launched in late 2021; and

- temporary shut-in of producing wells offsetting newly drilled wells to minimize interference during completion activities.

The result is the current decline rate from Q3 2021 to Q1 2022 appears steeper than the established decline rate of the area. The Fox Creek assets have only had a modest amount of capital spent on drilling in recent years by previous operators. As such, the annual production decline rates are relatively shallow in comparison to tight shale gas resource assets that have experienced more consistent allocation of drilling capital. When deploying a significant amount of capital to such upstream assets that have not been drilled for a number of years, the Company expects that the first year of production growth (i.e. 2023 over 2022) will be at a very high rate moderating with time and ongoing drilling.

There are no land expiry issues driving the Company’s operating plans in the Fox Creek Duvernay. After the development program is underway, the investments of one year will better align with the production additions from the prior year of investment for accurate annual capital efficiency calculations.

In the Montney, two wells (gross/net) drilled in late 2021 are scheduled for tie-in during the second quarter of 2022. One step-out delineation well (0.65 net) is planned during 2022 with an early 2023 tie-in, therefore not contributing to 2022 production or cash flow.

The Company’s producing assets, in the vast majority, are tight shale gas resources. The Company uses horizontal wells with multiple hydraulic fractures along the horizontal lateral. In Kiwetinohk’s view, this technology is not mature and reliable models based on physics and/or statistics do not exist. Despite the inadequacies of the approach, the Company looks for correlation between well performance and controllable factors (such as well lateral spacing, lateral length, number of fracs, frac slurry volume, frac pump rate) and uncontrollable factors (such as pressure-depth ratio, resource thickness, condensate to gas ratio, original gas in place per square metre). Performance is thereby estimated with reservations about accuracy from judgements made relative to this kind of data analysis. In order to account for unexpected outcomes, the Company includes capital without production for 1 well out of each 10 planned.

Corporate guidance

Contingent payment

Asset Retirement Obligations (ARO):

Risk management:

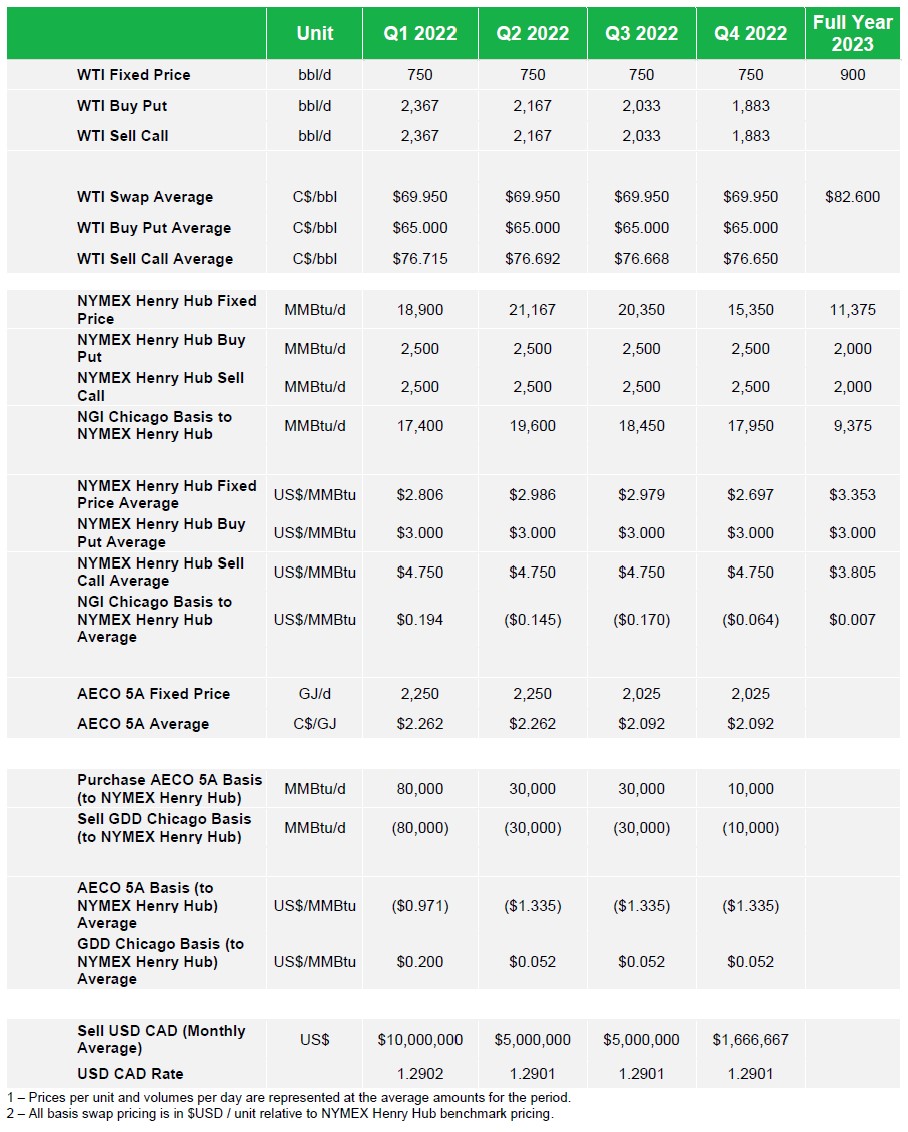

Kiwetinohk has a risk management program designed to protect returns on capital deployed. The Company targets to hedge up to 75% of its first 12 months of future production as it is brought onstream. To date, Kiwetinohk has used a combination of fixed price swaps and costless collars. Please see the Company’s updated hedging summary below for a full detail of Kiwetinohk’s current hedging contracts.

As Kiwetinohk advances its green energy projects toward FID it will look to contract power and hydrogen as appropriate.

Marketing activities:

2022 Guidance:

The following tables detail and summarize Kiwetinohk’s full year 2022 operational and financial guidance.

Risk management contracts:

The following tables detail and summarize Kiwetinohk’s full year 2022 operational and financial guidance.The Company has the following risk management contracts outstanding as of December 31, 2021:

Notes to the news release

1 Adjusted Funds Flow is a non-GAAP measure. See disclaimers regarding “Non-GAAP Measures” and “Future-Oriented Financial Information” below.

2 Return on average capital employed is a non-GAAP measure. See disclaimer regarding “Non-GAAP Measures” below.

3 The term “Firm Renewable” is a Kiwetinohk-originated term that describes efficient, flexible-output, fast-responding, gas-fired, internal reciprocating engine-driven power generation that addresses the need for stability that has been revealed as solar and wind renewable grows to become a significant proportion of a grid’s power supply. Firm Renewable bridges supply gaps related to intermittency of renewables and system outages while maximizing opportunity to capture power price spikes.

4 Reserves estimates are based upon the report prepared McDaniel & Associates Consultants Ltd. dated July 16, 2021, evaluating the reserves attributable to certain of the assets of Kiwetinohk and its subsidiaries as at July 1, 2021, assuming completion of the business combination of Kiwetinohk and Distinction Energy Corp. and an effective date of July 1, 2021

Operating netback is a non-GAAP measure. See disclaimer regarding “Non-GAAP Measures” below.

Recycle ratio is defined as the operating netback divided by the acquisition cost of the PDP reserves. This is calculated on a boe basis.

5 ARO expenditures are treated as a settlement of a liability and included in cash flow from operating activities. ARO, similar to changes in non-cash working capital, are added back to cash flow from operating activities in “Adjusted Funds Flow”.

Forward-looking statements

Certain information set forth in this document contains forward-looking information and statements including, without limitation, management’s business strategy, management’s assessment of future plans and operations. Such forward-looking statements or information are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Forward-looking statements or information typically contain statements with words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”, “propose”, “project”, “potential” or similar words suggesting future outcomes or statements regarding future performance and outlook. Readers are cautioned that assumptions used in the preparation of such information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of the Company.

Specifically, this document contains forward-looking statements pertaining to: the Company’s 2022 capital expenditures budget and allocations thereof; 2022 production guidance; drilling, advancement and completion of wells in the Fox Creek area and the timing associated with drilling and completion of the wells; the Company’s objectives, strategies and competitive strengths and weaknesses; the Company’s growth strategy; the Company’s plans for developing a low emission power generation business, including development of its natural gas-fired and solar and wind power generation projects and expectations with respect to future opportunities for other renewable energy projects; the Company’s ability to achieve its goals, including the Company’s ability to: bring its natural gas production into equivalent proportion with its use of natural gas for hydrogen and electricity production; and capture and utilize more than 90% of the carbon dioxide associated with Scope 1 emissions; timing for listing of the Company’s shares on the TSX; allocation of future free cash flow to fund additional green energy investment and return of capital to investors; anticipated strong production, revenue and cash flow growth late in 2022 and into 2023 resulting from drilling and completion of wells in 2021 and 2022; the magnitude of the Company’s contingent payment obligations arising from the property acquisition in April 2021; and 2022 operational and financial guidance.

In addition to other factors and assumptions that may be identified in this document, assumptions have been made regarding, among other things:

- the timing and costs of the Company’s capital projects;

- the impact of increasing competition;

- the general stability of the economic and political environment in which the Company operates;

- the ability of the Company to obtain qualified staff, equipment and services in a timely and cost efficient manner;

- the ability of the operator of the projects that the Company has an interest in to operate in a safe, efficient and effective manner;

- future commodity and power prices;

- the Company’s ability to realize on expectations regarding low supply cost, reliability and efficiency of its power generation portfolio;

- the expected performance of the Company’s current drilling activities;

- development and completion of the Company’s natural gas-fired and solar power generation projects in a timely and cost-efficient manner and the Company’s ability to continue to identify and progress projects for its power generation portfolio;

- the Company’s ability to successfully integrate its upstream business and assets with the Company’s power generation portfolio;

- the Company’s future production levels;

- the recoverability of the Company’s reserves;

- that the Company will have access to solar and other renewable resources in amounts and at the costs consistent with the amounts and costs expected by the Company for the development projects in its power generation portfolio;

- future cash flows from production;

- geological and engineering estimates in respect of the Company’s reserves;

- the geography of the areas in which the Company is conducting exploration and development activities and the access, economic, regulatory and physical limitations to which the Company may be subject from time to time;

- community and stakeholder commitment to sustainable energy sources, and the Company’s positioning within the sustainable energy or energy transition space;

- the Company’s ability to obtain financing necessary for the advancement of the Company’s business plan on acceptable terms;

- currency, exchange and interest rates;

- the regulatory framework regarding royalties, taxes, power, renewable and environmental matters in the jurisdictions in which the Company operates; and

- the ability of the Company to successfully market its products.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions that have been used. Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements as the Company can give no assurance that such expectations will prove to be correct.

Forward-looking statements or information involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by the Company and described in the forward-looking statements or information. These risks and uncertainties include, among other things:

- the ability of management to execute its business plan;

- general economic and business conditions;

- the risk of instability affecting the jurisdictions in which the Company operates;

- the risks of the power and renewable industries;

- the ability of the Company to successfully execute its energy transition strategy;

- risks associated with exploration, development and production of crude oil and natural gas, and drilling for unconventional oil, NGL and natural gas;

- the risks and limitations of forecasting reserves data;

- risks associated with operating and integrating a newly-combined business;

- competition in the crude oil and natural gas industry;

- carbon taxes and environmental compliance costs;

- operational and construction risks associated with certain projects;

- the possibility that government policies or laws may change or governmental approvals may be delayed or withheld;

- uncertainty involving the forces that power certain renewable projects;

- the Company’s ability to enter into or renew leases;

- potential delays or changes in plans with respect to power and solar projects or capital expenditures;

- fluctuations in commodity and power prices, foreign currency exchange rates and interest rates;

- risks inherent in the Company’s marketing operations, including credit risk;

- health, safety, environmental and construction risks;

- risks associated with existing and potential future lawsuits and regulatory actions against the Company;

- coronavirus;

- market constraints and access to services and equipment;

- talent, recruitment and retention of key personnel;

- technology risks;

- seasonality;

- uncertainties as to the availability and cost of financing;

- and financial risks affecting the value of the Company’s investments.

Readers are cautioned that the foregoing list is not exhaustive of all possible risks and uncertainties.

The forward-looking statements and information contained in this document speak only as of the date of this document and the Company undertakes no obligation to publicly update or revise any forward-looking statements or information, except as expressly required by applicable securities laws.

Non-GAAP measures

This news release contains measures that do not have a standardized meaning under generally accepted accounting principles (“GAAP”) and therefore may not be comparable to similar measures presented by other entities. These performance measures presented in this document should not be considered in isolation or as a substitute for performance measures prepared in accordance with GAAP and should be read in conjunction with the consolidated financial statements of the Company. Readers are cautioned that these non-GAAP measures do not have any standardized meanings and should not be used to make comparisons between Kiwetinohk and other companies without also taking into account any differences in the method by which the calculations are prepared.

Adjusted funds flow is cash flow from operating activities before changes in non-cash working capital from operating activities, decommissioning expenditures, restructuring costs, acquisition costs and settlement agreement costs.

Return on average capital employed is calculated as adjusted funds flow divided by the average of opening and closing capital employed for the 12 months preceding the period end. Capital employed includes common shares, contributed surplus, deficit and net debt. Net debt is comprised of loans and borrowings plus adjusted working capital deficit (surplus) and represents the Company’s net financing obligations.

Operating netback is calculated on a per boe basis as petroleum and natural gas revenue from production (before hedging) less royalties, operating and transportation expense.

Future-oriented financial information Financial outlook and future-oriented financial information contained in this presentation about prospective financial performance, financial position or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, based on management’s assessment of the relevant information currently available. In particular, this presentation contains expected adjusted funds flow, return on capital employed, capital costs and power generation capacity of the Company’s proposed power generation capital projects, forecast economics of the Company’s oil and gas assets and 2022 financial outlook information for the Company, including expected royalty rates, operating costs, transportation expenses, corporate G&A expenses and cash taxes. These projections contain forward-looking statements and are based on a number of material assumptions and factors set out above and are provided to give the reader a better understanding of the potential future performance of the Company in certain areas. Actual results may differ significantly from the projections presented herein. These projections may also be considered to contain future oriented financial information or a financial outlook. The actual results of the Company’s operations for any period will likely vary from the amounts set forth in these projections, and such variations may be material. See above and “Risk Factors” in the Company’s AIF published on the Company’s profile on SEDAR at www.sedar.com for a further discussion of the risks that could cause actual results to vary. The future oriented financial information and financial outlooks contained in this presentation have been approved by management as of the date of this presentation. Readers are cautioned that any such financial outlook and future-oriented financial information contained herein should not be used for purposes other than those for which it is disclosed herein.

Future-oriented financial information

Financial outlook and future-oriented financial information contained in this presentation about prospective financial performance, financial position or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, based on management’s assessment of the relevant information currently available. In particular, this presentation contains expected adjusted funds flow, return on capital employed, capital costs and power generation capacity of the Company’s proposed power generation capital projects, forecast economics of the Company’s oil and gas assets and 2022 financial outlook information for the Company, including expected royalty rates, operating costs, transportation expenses, corporate G&A expenses and cash taxes. These projections contain forward-looking statements and are based on a number of material assumptions and factors set out above and are provided to give the reader a better understanding of the potential future performance of the Company in certain areas. Actual results may differ significantly from the projections presented herein. These projections may also be considered to contain future oriented financial information or a financial outlook. The actual results of the Company’s operations for any period will likely vary from the amounts set forth in these projections, and such variations may be material. See above and “Risk Factors” in the Company’s AIF published on the Company’s profile on SEDAR at www.sedar.com for a further discussion of the risks that could cause actual results to vary. The future oriented financial information and financial outlooks contained in this presentation have been approved by management as of the date of this presentation. Readers are cautioned that any such financial outlook and future-oriented financial information contained herein should not be used for purposes other than those for which it is disclosed herein.

Oil and gas disclosure

Abbreviations

$/bbl

dollars per barrel

$/boe

dollars per barrel equivalent

$/GJ

dollars per gigajoule

$/mcf

dollars per thousand cubic feet

bbl(s)

barrel(s)

bbl/d

barrels per day

boe

barrel of oil equivalent, including crude oil, condensate, natural gas liquids, and natural gas (converted on the basis of one boe per six mcf of natural gas)

boe/d

barrel of oil equivalent per day

GJ

gigajoule

GJ/d

gigajoule per day

mcf

thousand cubic feet

mcf/d

housand cubic standard feet per day

MM

million

MMcf/d

million cubic feet per day

MMBtu

one million British thermal units (Btu) is a measure of the energy content in gas

MMBtu/d

million cubic feet per day

NGLs

one million British thermal units per day

WTI

West Texas Intermediate, which is an oil benchmark

About Kiwetinohk

We, at Kiwetinohk, are passionate about climate change and the future of energy. Kiwetinohk’s mission is to build a profitable energy transition business providing clean, reliable, dispatchable, low-cost energy. Kiwetinohk develops and produces natural gas and related products and is in the process of developing renewable, natural gas-fired power, carbon capture and hydrogen clean energy projects. We view climate change with a sense of urgency, and we want to make a difference.

Kiwetinohk is a reporting issuer and additional information is available on Kiwetinohk’s SEDAR profile at www.sedar.com.

FOR MORE INFORMATION ON KIWETINOHK, PLEASE CONTACT:

Mark Friesen, Director, Investor Relations

IR phone: (587) 392-4395

IR email: IR@kiwetinohk.com

Address: Suite 1900, 250 – 2 Street S.W. Calgary, Alberta T2P 0C1

Pat Carlson, CEO

Jakub Brogowski, CFO

www.kiwetinohk.co